The Future of Forex AI Trading Bots Transforming Currency Markets

The Future of Forex: AI Trading Bots Transforming Currency Markets

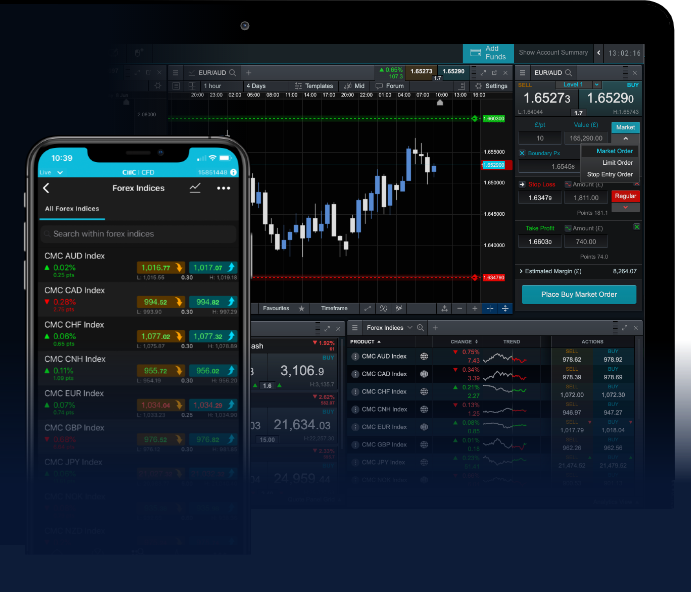

In the rapidly evolving world of finance, technology plays an increasingly vital role. One of the most significant advancements in recent years is the integration of artificial intelligence (AI) into forex trading. The emergence of forex ai trading bot seed2019.io and other platforms has showcased the potential of AI trading bots, poised to revolutionize the currency exchange markets.

Understanding Forex Trading

Forex, or foreign exchange, is the marketplace for trading national currencies against one another. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Forex trading involves buying one currency while simultaneously selling another and is traditionally dominated by banks, financial institutions, and individual traders. While human traders rely on experience, analysis, and instinct, the advent of technology, particularly AI, is ushering in a new era of trading.

What Are AI Trading Bots?

AI trading bots are automated software programs designed to analyze market data, execute trades, and manage the trading process with minimal human intervention. These bots utilize complex algorithms and machine learning techniques to predict market movements, identify trading opportunities, and execute trades with speed and precision. Their capabilities include:

- Data Analysis: Bots can process vast amounts of data, identifying trends and patterns that human traders might overlook.

- Speed: AI trading bots operate at speeds far greater than human traders, enabling them to capitalize on fleeting market opportunities.

- 24/7 Trading: Unlike human traders, bots can operate around the clock, taking advantage of market fluctuations at any time of day.

Benefits of Using AI Trading Bots

While there are numerous benefits to utilizing AI trading bots in Forex trading, a few key advantages stand out:

1. Improved Decision-Making

AI trading bots employ sophisticated algorithms that analyze historical data and current market conditions to make informed trading decisions. This reduces the emotional bias that often affects human traders, leading to more rational and consistent outcomes.

2. Minimized Risk

AI trading bots can help manage risk effectively by implementing stop-loss orders and other protective measures. They can quickly react to market changes, reducing potential losses and safeguarding capital.

3. Customizability

Traders can tailor AI trading bots to align with their specific trading strategies and risk profiles. Whether a trader prefers aggressive strategies or more conservative approaches, bots can be programmed to accommodate a wide range of trading styles.

4. Continuous Learning and Improvement

Machine learning capabilities enable AI trading bots to continuously improve their performance over time. As they analyze more data and adapt to changing market conditions, their trading strategies evolve, enhancing their effectiveness.

Challenges and Considerations

While the advantages of AI trading bots are compelling, there are also challenges and considerations that traders should keep in mind:

1. Market Volatility

Forex markets can be highly volatile, influenced by economic reports, geopolitical events, and other factors. Bots may struggle to adapt quickly to sudden market shifts, potentially leading to losses.

2. Over-reliance on Automation

While AI trading bots can enhance trading strategies, over-reliance can lead to complacency among traders. It’s crucial to maintain an understanding of market dynamics and not let automation completely replace human judgment.

3. Technical Issues

Technical glitches such as server downtimes or software bugs can compromise trading operations. Traders need to monitor their bots regularly and ensure they function correctly.

Choosing the Right AI Trading Bot

When selecting an AI trading bot for forex trading, it’s essential to consider several factors:

1. Reputation and Reviews

Look for bots with positive reviews and a solid reputation in the trading community. Research user experiences to gauge a bot’s effectiveness and reliability.

2. Performance Metrics

Examine historical performance metrics, including win rates and drawdowns. Understanding how a bot has performed in various market conditions is crucial before entrusting it with your capital.

3. Customer Support

A responsive and knowledgeable customer support team can be invaluable, especially when encountering technical issues or requiring assistance in utilizing the bot effectively.

Conclusion

AI trading bots are changing the landscape of forex trading, offering efficiency, precision, and the potential for increased profitability. As technology continues to advance, these bots will likely become even more sophisticated, providing traders with powerful tools to navigate the complex world of foreign exchange. However, successful trading will always require a balance of technology and human insight, ensuring that traders remain engaged and informed in an increasingly automated environment.