Understanding Forex Trading A Comprehensive Guide 1970803032

What is Forex Trading?

Forex trading, or foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit. It is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. The Forex market operates 24 hours a day, five days a week, and offers traders opportunities to capitalize on currency fluctuations. To get started in Forex trading, you can visit what is forex trading https://acev.io/ for insights and trading tools.

How Forex Trading Works

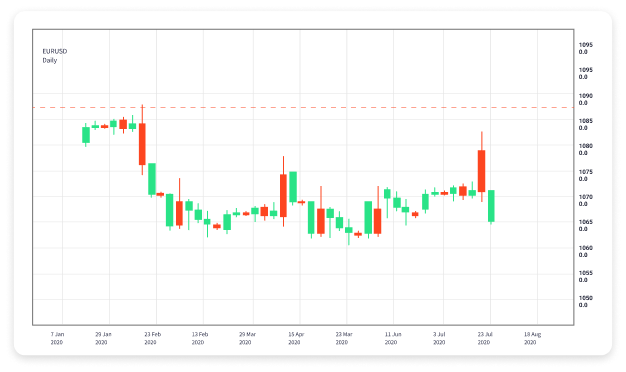

The Forex market essentially involves the exchange of one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY), where the first currency is the base currency, and the second is the quote currency. When you trade a currency pair, you speculate on whether the base currency will strengthen or weaken against the quote currency.

For example, if you believe the Euro (EUR) will strengthen against the US Dollar (USD), you would buy the EUR/USD pair. Conversely, if you think the Euro will weaken, you would sell the pair. The difference in prices from the time of the trade until you close it determines your profit or loss.

The Role of Forex Brokers

Forex brokers act as intermediaries between traders and the Forex market. They provide platforms, tools, and resources for traders to execute their trades. When selecting a broker, it’s essential to consider factors such as regulation, spread, leverage, and trading platform quality.

Brokers may charge a commission or a spread, which is the difference between the buying and selling price of a currency pair. The choice of a broker can significantly impact your trading experience and profitability.

Types of Forex Trading

There are several types of Forex trading strategies that traders commonly use. These include:

- Day Trading: Traders buy and sell currencies within the same trading day, aiming to capitalize on short-term price movements.

- Swing Trading: This strategy involves holding positions for several days or weeks to profit from expected price shifts.

- Scalping: Traders look for small price gaps and make numerous trades throughout the day to accumulate profits.

- Position Trading: This long-term strategy focuses on holding positions for extended periods, ranging from weeks to years.

Forex Markets and Participants

The Forex market is comprised of several participants, including:

- Central Banks: They manage a country’s currency, money supply, and interest rates, often intervening in the market to stabilize or influence their economy.

- Commercial Banks: Major banks facilitate currency transactions for clients and engage in Forex trading for profit.

- Corporations: Companies involved in international trade need to hedge against currency fluctuations to protect their profits.

- Retail Traders: Individual traders participate in the Forex market through brokers, using personal capital to engage in trades.

Pip, Lots, and Leverage

Understanding some key concepts in Forex trading is crucial for successful trading. A pip is the smallest price movement in a currency pair. In most pairs, a pip equals 0.0001; however, some pairs, like the Japanese Yen (JPY), have a pip value of 0.01.

A lot refers to the size of a trade. Standard lots are typically 100,000 units of the base currency, while mini lots are 10,000 units, and micro lots are 1,000 units. The size of your lot can affect your overall risk and potential profits.

Leverage allows traders to control a larger position size with a smaller amount of capital. For example, a leverage ratio of 100:1 means that for every $1 you invest, you can control $100 in the market. While leverage can amplify profits, it also increases the risk of significant losses.

Risks In Forex Trading

Forex trading carries inherent risks, including market volatility, leverage risk, and emotional risk. Prices can fluctuate rapidly due to economic news, political events, or market sentiment. Traders must be aware of these risks and establish a risk management strategy to protect their capital.

One crucial aspect of risk management is setting stop-loss orders, which automatically close a trade at a predetermined price to limit losses. Additionally, responsible leverage use and position sizing can mitigate risks associated with Forex trading.

Fundamental vs. Technical Analysis

Traders often use two main types of analysis: fundamental and technical analysis, to make informed trading decisions.

Fundamental Analysis: This approach focuses on economic indicators, interest rates, and geopolitical events that can affect currency values. Traders analyze reports such as GDP, employment rates, and inflation data to gauge a currency’s strength or weakness.

Technical Analysis: This method involves analyzing historical price movements and patterns using charts and technical indicators. Traders utilize tools like moving averages, support and resistance levels, and relative strength index (RSI) to predict future price movements.

Conclusion

Forex trading can be an exciting and potentially lucrative opportunity for those willing to learn and hone their skills. Understanding the principles of how the market operates, developing a solid trading plan, and practicing risk management are essential for long-term success. Whether you are a beginner or an experienced trader, continuous learning is key in navigating the ever-evolving Forex landscape.