Value Sheet : Which Means, Significance, Varieties, Parts, Format & Instance

Evaluating prices with trade standards helps companies keep aggressive in a dynamic market surroundings. Price evaluation facilitates efficiency evaluation, identifies market positioning alternatives, and supports strategic planning initiatives. Benchmarking enables corporations to assess competitiveness, optimize pricing methods, and maintain market leadership positions successfully.

- Knowing what is cost sheet analysis reveals critical expense categories, enabling managers to identify areas requiring consideration and optimization.

- Obtain development finances templates in Excel for new residence building, residential and business tasks, renovation & more.

- Whether Or Not you run a producing agency, a startup, or a service-based business, mastering price sheets can streamline your monetary technique and enhance operational efficiency.

- A cost sheet helps businesses effectively allocate assets by showing which departments or manufacturing processes incur the most significant costs.

Value sheets in accounting should accommodate industry-specific reporting standards, making certain correct tax calculations and regulatory compliance throughout different enterprise verticals. Sum all costs and divide by the number of units to find the price per unit for accurate pricing selections. This calculation supplies important information for profitability evaluation, pricing methods, and operational effectivity analysis. Assess which products or services yield the highest margins through detailed value breakdown analysis.

Useful Resource Allocation

A price sheet typically covers all prices from the preliminary stage of production to the finished product ready for sale. It data every little thing from raw materials and labor to manufacturing facility overheads and administrative bills. This comprehensive method ensures that no price is ignored, allowing for extra accurate price control.

The first calculation is the prime cost, which is the sum of all of your direct costs. To discover the value of manufacturing, you add administrative overheads and make changes for inventory. The complete cost of production for the batch is calculated by compiling all relevant value categories. Once the total price is understood types of cost sheet, it is divided by the number of items within the batch to find the fee per unit. Whereas an estimated value sheet is not as exact as a historic one, it provides useful foresight.

You use cost sheets to calculate and analyze production prices, aiding internal choices like pricing and value https://www.quick-bookkeeping.net/ control strategies. These detailed analyses help operational efficiency, useful resource optimization, and strategic planning. Price sheets enable managers to determine price drivers, evaluate profitability, and make knowledgeable decisions about production processes, pricing strategies, and useful resource allocation.

Enhanced Visibility And Data-driven Selections

Ensure staff involved in price monitoring understand the significance and methodology to reduce errors. Together With an excessive amount of element could make the cost sheet tough to maintain and interpret. To illustrate advanced value sheet use, think about a mid-sized furnishings manufacturer that produces tables and chairs. Using digital record-keeping and accounting software program can streamline this course of. Implementing systematic bookkeeping and utilizing accounting software can significantly ease knowledge assortment.

Classifying Prices Correctly

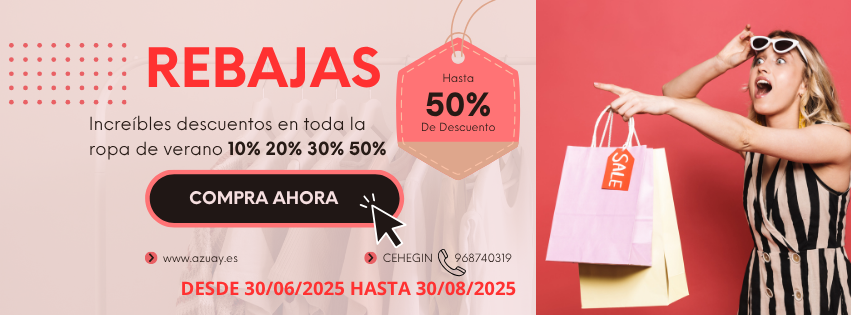

Retail companies face unique challenges in value sheet preparation, especially during festive seasons. Figuring Out what is value sheet in retail includes managing fluctuating stock costs, seasonal procurement, and storage bills. Business cost sheets must account for bulk buying discounts, inventory holding costs, and seasonal markdowns.

Any firm that wants to grasp how much it prices to create a services or products can profit from maintaining a cost sheet. It acts as a roadmap that reveals the place money is being spent and how those expenses contribute to the ultimate cost of the product or service. Although price sheets are typically and more incessantly used in manufacturing companies, they can be useful for service providers.

As a enterprise proprietor or supervisor in India, understanding your costs is essential for achievement. A cost sheet is a vital software that helps you break down expenses, make informed choices, and enhance profitability. This guide explores the definition, parts, varieties, and practical functions of price sheets, tailored for the Indian market.

In the world of value accounting, cost sheets are extra than just paperwork; they’re important for sensible cost management. They provide an in depth breakdown of your manufacturing price, which is step one towards efficient price control. By exhibiting you precisely where your cash is spent, you presumably can identify areas where expenses could be too high. By breaking down each price factor, it becomes easier to establish areas the place costs are rising unnecessarily. For example, if the value of uncooked materials increases, a manager can look into different suppliers or negotiate better offers.

Understanding total production price helps companies set up a selling worth that not solely covers all expenses but also achieves desired profit margins. This detailed price breakdown helps be sure that pricing methods are grounded in monetary actuality. These overhead prices are categorised as fixed overhead (constant, e.g., manufacturing facility rent) or variable overhead (fluctuates with production, e.g., electrical energy for working machinery). Conversion value is the sum of direct labor and manufacturing overhead, representing bills incurred to rework raw supplies into completed goods. Prime cost should embody direct materials, direct labor, and different direct expenses.